Kilroy Was Here

February 14, 2003

Corporate Weasel Watch Update: Tax Evasion and Large Corporations

Yesterday, NPR's All Things Considered had three stories on Tax Evasion and large corporations. Here's some interesting notes I took from these reports.

In ATC's Enron story:

- Enron paid no taxes on over $2 billion dollars of reported income.

- Enron had 12 separate tax shelters set up.

- These shelters allowed Enron to count losses twice as well as count depreciation on assets that would normally not be counted.

- None of these tax shelters had any legitmate business purpose.

- Enron's tax department was run like a profit center with revenue targets.

- Enron claimed attorney-client privelege in order to hide important documents from government auditors.

- 200 of Enron's top executives earned over $1.4 billion dollars in 2000 alone!

- These executives evaded their tax responsibility by structuring this income as deferred income.

- These executives accellerated the use of this deferred revenue as they saw the impending doom of Enron approaching.

In ATC's Sprint story:

- Instead of a flat fee, tax advisers often charge a percentage of what their clients avoid in their tax responsibility.

- Favorite Quote: "It's pretty ugly, because you really don't expect or want tax advisers getting paid on how much they cheat." (Robert McIntyre, Citizens for Tax Justice)

Most importantly, ATC had a great short segment on the growing gap between the income reported to the markets (book income) and the income reported to the IRS (tax income). Corporations keep two sets of books: one which emphasizes their income to justify higher stock prices from capital markets, and one which limits their income as much as possible to limit their tax responsibilty.

Most importantly, ATC had a great short segment on the growing gap between the income reported to the markets (book income) and the income reported to the IRS (tax income). Corporations keep two sets of books: one which emphasizes their income to justify higher stock prices from capital markets, and one which limits their income as much as possible to limit their tax responsibilty.

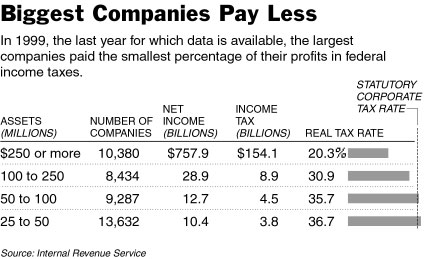

The IRS estimates a gap between reported book income and reported tax income of over $155 billion dollars in the last year. As the chart to the left shows, most of this gap is created by the largest companies. This is because the largest companies are able to take advantage of some of the differing rules (i.e. options). Also, since evading your tax responsibility can be complicated, it takes a significant amount of money to structure these complex tax shelters.

If we eliminated the different tax and book accounting rules and just had corporations report one set of books, we could have more credibility and more oversight on the finances our public companies report to the street.

Something we desperately need these days.

UPDATE

Here's a link to a paper by Harvard's Mihir A. Desai on the growing gap between book and tax income: (http://www.people.hbs.edu/mdesai/divergence.pdf).

From Slate's discussion of this paper:

In 1993, at firms with more than $250 million in assets—which pay the overwhelming majority of corporate income taxes—the two figures were rather close. Such companies claimed $1.12 in book income for every dollar in tax income. But Desai shows that the ratio rose in each of the following five years so that by 1998 large companies were reporting $1.63 in book income for each dollar of tax income. That year, in fact, tax income fell 10.8 percent while book income rose 0.8 percent. In dollar terms, the gap between the two figures rose from $37 billion in 1993 to $172 billion in 1996 to $247 billion in 1998.

Comments:

Post a Comment